Mortgage Lenders in Wilmington, NC

Ready to find a home in Wilmington you can call your own? We’re here to help. With the best rates in the biz, a dedicated Mortgage Coach, and a way simpler, faster home financing process, Dash is your one-stop mortgage shop.

Dash Home Loans’ Wilmington, NC Mortgage Office

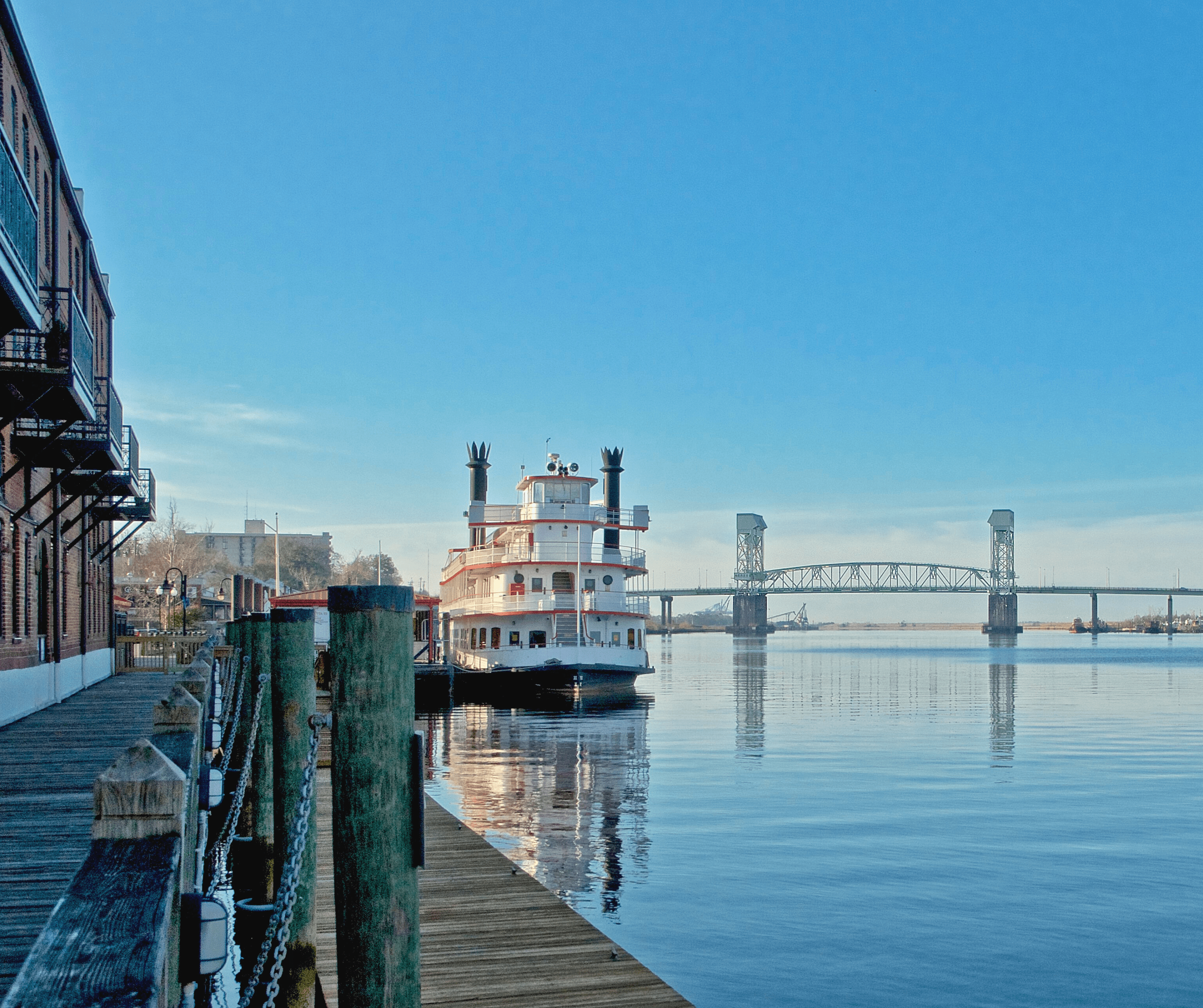

Whether you’re ready to buy a beachside bungalow, a condo overlooking the Cape Fear River, or a suburban oasis, the Dash Mortgage Coaches at our Wilmington office will make the home buying process a (sea) breeze.

We're open...

Monday to Friday: 9AM – 5PM

Saturday & Sunday: Closed

Home Loans & Mortgage Refinancing in Wilmington, NC

Buying a home is complicated, but it doesn’t have to suck. At Dash Home Loans, we’re dedicated to comprehensive home financing solutions that make every aspect of mortgage lending smooth sailing, including:

- Home loans3

- Mortgage refinancing4

- Soft credit pulls

- Pre-qualification assistance

- Knowledgeable mortgage advice

- And more!

Kind of like Wilmington itself, Dash has big-city amenities wrapped in a small-town package. As a division of Primary Residential Mortgage, Dash has the resources and clout of a big-time mortgage company. But as a dedicated lender to North and South Carolina, our Mortgage Coaches feel like – and are – your neighbors. So neighborly service is our top priority.

Whether you’re ready to pre-qualify for a loan or just have some questions to ask, our Wilmington Mortgage Coaches are here to help. Give us a call at 910-597-1143 to schedule an appointment.

A New Name in the Wilmington Mortgage Game

The first step in buying a home? Finding a mortgage lender. Traditionally, that meant getting shuffled between paper pushers and middlemen, which isn’t exactly a fun way to kick off the home buying process. That’s why we’re doing things differently.

At Dash Home Loans, we get that buying a house is kind of a big deal, and we want to help you every step of the way. When you choose Dash, you’ll get the dedicated attention of your own Mortgage Coach.

Wondering how else we’re doing things differently? Glad you asked:

- A straightforward, efficient home loan process

- A range of home loan options

- Insight and support for all home buyers – even those with unique circumstances

- First-class service – don’t take our word for it, see for yourself

- After pre-qualifying with Dash, a guaranteed loan closing1 – restrictions apply

Every home – and every home buyer – is different. That’s why we offer personalized, supportive mortgage lending that’s designed to get you into your new home faster with as few snags as possible. If you’re ready to call Wilmington home, we’re ready to help!

Apply now

All Kinds of Home Loans for All Kinds of

Wilmington Buyers

Mortgages aren’t one-size-fits-all (far from it), but Dash kind of is. We believe all home buyers – first-time, experienced, and everything in between – deserve a tailored approach to home financing. No matter what kind of home buyer you are or what kind of home you’re buying, there’s a Dash loan that’s just right for you.

We offer a variety of Wilmington home loan options3, and all of them are paired with our unparalleled service and one-on-one guidance. Our home loan programs include:

- Manufactured home loans

- Chenoa Fund™ home loans

- HUD program loans

- Fresh start home loans

- FHA 203K dream loans

- FHA 203(h) disaster relief loans

- And more!

First-time home buyer here, and I will use Dash for every home I buy! The process was super easy to understand and super easy to access online. They don’t try to BS you, and they help you every step of the way.

— Adam, Home Loan customer

Mortgage Refinancing in Wilmington, NC

You love your home (yay!), but maybe you’re looking to save a little dough or build up your rainy-day fund. Refinancing could be just the ticket. If you’re hesitant to undergo the hassle of a refinance, don’t be. Like all of our mortgage options, Dash’s process of refinancing your Wilmington home is quick and consistent.

We’ll make sure your mortgage refinance4 goes swimmingly so you can reap the benefits, including:

- Lowering your interest rate

- Reducing your monthly payment

- Using your equity for other expenses

- Consolidating your debt

We’re not saying we can make refinancing “fun,” but we are saying we’ll help make it a whole lot simpler. Have questions about what that might look like? Schedule an appointment with one of our Mortgage Coaches, and we’ll clarify all your refinancing questions.

Dash Home Loans was able to get us a great rate and made refinancing easy. What could have been a long and painstaking process was simplified with how they communicated clear steps to follow.

— Mark, Refinance customer

The Dash Mortgage Process for Wilmington

Home Buyers

At Dash Home Loans, we make the whole mortgage process as transparent as possible. Where most big banks will shuffle you between hands, Dash will pair you with a dedicated Mortgage Coach who will work with you every step of the way.

Plus, most mortgage lenders can’t guarantee your loan, so if it falls through, you and the seller are in one tough pickle. But with Dash, you’ll get the Dash Loan Closing Guarantee – more on that below.

We keep saying the Dash loan process is efficient, and we’ll prove that it’s as easy as one, two, three:

Step 1:

Apply With Us

We simplify things from the get-go with an easy online application. Once we’ve got that, we’ll be able to pair you with a Dash Mortgage Coach – your BFF throughout the lending process.

Step 2:

Get Pre-Qualified

When you pre-qualify with Dash, you’ll also be able to boast the Dash Loan Closing Guarantee1. That means that if the loan falls through, you won’t be left in the lurch. We’ll give you and the seller $5,000 smackaroos each. That’s like the cherry on top when sellers are considering offers. You’re welcome.

Step 3:

Close on Time

They don’t call us Dash for nothing! Unlike most mortgage lenders, we like to get things done fast. In fact, we regularly work with clients whose first mortgage fell through and still help them close on time. Time is valuable, and we know you’d rather spend it in your new home.

That’s the Dash mortgage process in a nutshell. The only thing we left out? The level of service we provide to every single customer. We’re not just mortgage lenders – we’re homeowners and Wilmingtonians, so we get it. We provide the kind of support we’d like to receive, and that just happens to be superb.

Apply nowLegal information

¹ Dash Loan Closing Guarantee Disclaimer: Guarantee is based on loan closing; restrictions apply.

² No-Down-Payment Disclaimer: Closing costs and fees may still apply.

³ Lending Disclaimer: Mortgage rates are subject to change and are subject to borrower(s) qualification. APR rate(s) quoted is/are based upon a (loan amount), (loan term, including whether fixed or ARM) year.

⁴ Refinancing Disclaimer: When it comes to refinancing your home loan, you can generally reduce your monthly payment amount. However, your total finance charges may be greater over the life of your loan. Your PRMI loan professional will provide you with a comprehensive refinance comparison analysis to determine your total life loan savings.

⁵ VA Home Loan Disclaimer: VA home loan purchases have options for 0% down payment, no private mortgage insurance requirements, and competitive interest rates with specific qualification requirements. VA interest rate reduction loans (IRRRL) are only for veterans who currently have a VA loan – current loan rate restrictions apply, and limits to recoupment of costs and fees apply. VA cash-out refinances are available for veterans with or without current VA loans. Policies and guidelines may vary and are subject to the individual borrower(s) qualification. Program and lender overlays apply.

⁶ Down Payment Assistance Disclaimer: First lien interest rates may be higher when using a DPA second.

⁷ Pre-Approval Disclaimer: Pre-approvals are given to clients who have met qualifying approval criteria and specific loan requirements at the time of applications. Results may vary.

General Disclaimer: The content on this page has not been approved, reviewed, sponsored, or endorsed by any department or government agency.

NMLS® Consumer Access℠: https://nmlsconsumeraccess.org/

North Carolina Mortgage Branch License: L-112833-200

South Carolina-BFI Branch Mortgage Lender/Service License: MLB-1439905, MLB-1439905 OTN #2