Home loans & refinancing

Dash It & Own It.

Faster, simpler home financing, guaranteed¹

Let's be honest – getting a home loan sucks. But it doesn't have to.

We’ve changed the home loan process to make it work for you. No middleman, no extra steps. Just a simple process that lets us move fast, so you can too.

Meet Our Mortgage Coaches

We’re your home loan lender BFFs

Hassle-Free Home Loans

We’ve simplified and streamlined the home loan process to make it faster, easier, and all around less horrible.

People-Focused Mortgage Coaches

You’re not a number. You’re a person with feelings, and we want you to feel good (or at least okay) about the home loan process. Let our experienced mortgage coaches guide you step by step.

Dash Home Loan Guarantee

The best mortgage lenders put their money where their mouth is. We guarantee¹ you’ll close on a home loan – or we’ll pay up.

Are we the Southeast's best home lenders?

We sure are.

It’s not polite to brag, we know. But what about letting other people brag about us? To understand why Dash Home Loans is so popular, it’s best to hear it from our customers themselves. We’ve built our national reputation one story (and home) at a time.

Home Loans

Dash makes home loans in the Southeast easier

Need a home loan³ in the Southeast? Whether it’s your first home or your fifth, we can help you get the loan you need.

- Simplified home loan process with no middlemen

- Your personal Mortgage Coach will help you every step of the way

- Closing guarantee (if not, you and the seller each get $5,000 on us)

Home Refinancing

Top Mortgage Refinance Lenders in the Southeast

Dash Home Loans refinances existing home loans so you can improve your finances. We’ll help you refinance⁴ your home to:

- Lower your monthly mortgage payment

- Get a better interest rate (or switch from a variable to fixed-rate mortgage)

- Transform your home equity into cash for other needs, such as debt repayment or home renovation projects

No matter what type of loan you’re looking for or how unique (or conventional) your circumstances, the Dash loans team will make working with a mortgage lender easier than you thought possible.

Taking care of first-time home buyers in the Southeast

You’ve never owned a home before, but you’re ready to build wealth and create a more permanent home for yourself or your family.

Lenders to keep up with experienced home buyers

It may not be your first rodeo, but it could be your easiest. We’ll show you what a home loan looks like without the complication.

A home loan fit for unique home buyers

Self-employed? Cool. Credit history woes? It’s okay. Don’t let one of the billion things that makes you special stop you from reaching out.

Carolina realtors trust Dash Home Loans

Want to give clients peace of mind that they can buy the home you’re showing? We can help.

We care deeply about our people and their communities

Dash Loan Closing Guarantee

Close on a home with confidence

Home loans fall through all the time – and usually at the 11th hour. With other mortgage companies, even a pre-qualification doesn’t guarantee you’ll close on your home loan. We do things differently. We back our pre-qualification with a $10,000 guarantee.

We’re so confident that your home loan will go smoothly that we’ll give $5,000 to you and $5,000 to the seller if you don’t close as expected. Even if you don’t cash in on this offer (and it’s not at all likely), our guarantee¹ makes your offer stronger to the seller and gives you peace of mind during the home loan process. Conditions apply.

Easy Home Loans Throughout

the Southeast

Dash Home Loans is a different kind of mortgage company. With a history of going to bat for our clients, we offer multiple types of home loans in the Carolinas, Virginia, Florida, Tennessee, and other Southeastern regions.

Get a Home Loan That’s Right for You

With Dash Home Loans

We’re home loan matchmakers. We pride ourselves on matching all kinds of buyers with the best loan types for them. No down payment², big down payment, tiny house, mansion? It doesn’t matter. Tell us about you and your dream home, and we’ll match you with the home loan option that gives you the savviest deal. Here are a few of our home loan options:

- Adjustable-rate mortgages (ARM)

- Conventional home loans

- VA home loans

- USDA home loans

- FHA home loans

- Investment property loans

- Jumbo home loans

- And more!

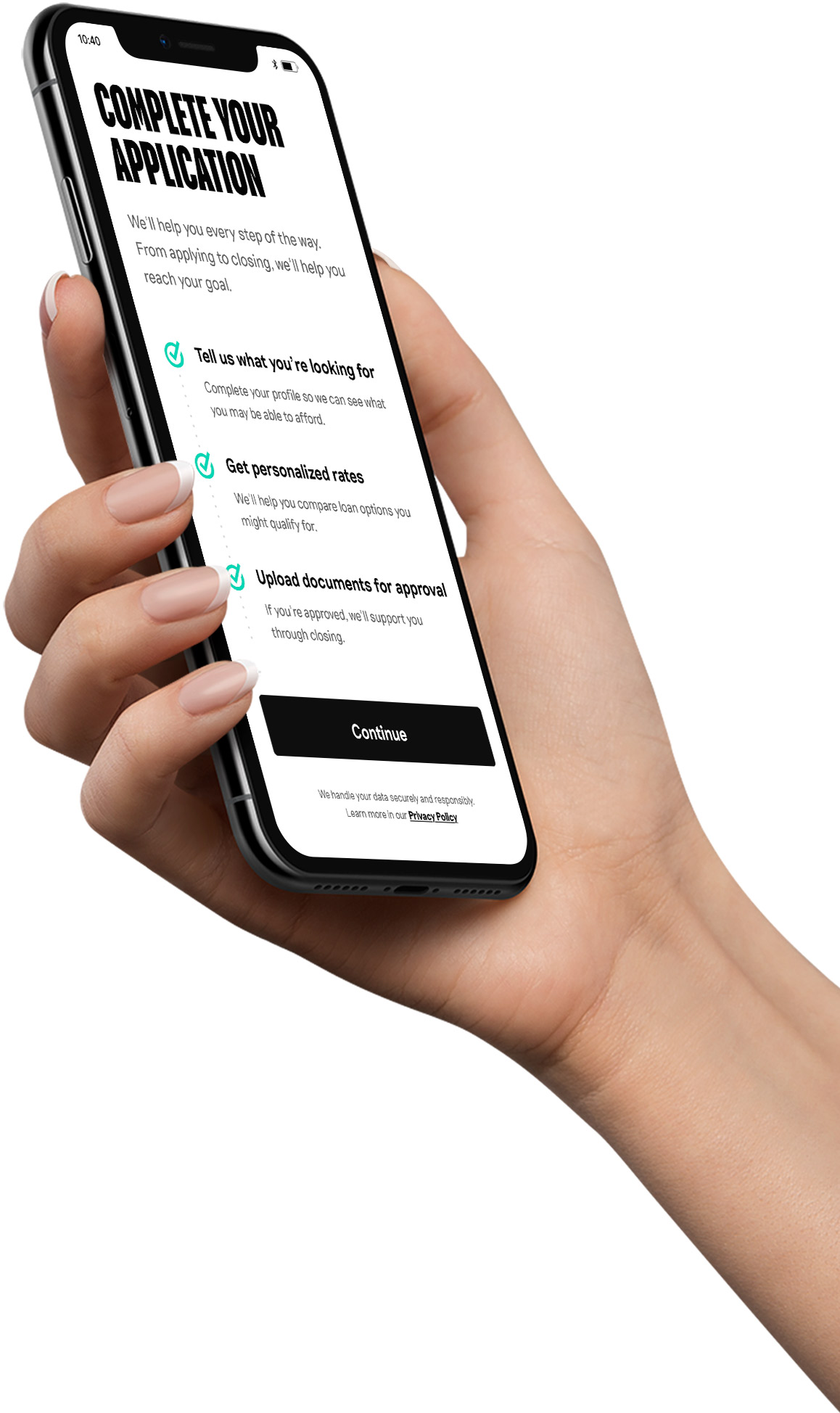

The Dash Home Loan Application Process

To get a home loan in the Southeast, traditional mortgage lenders typically involve far more people than you’ll ever actually meet, making it easy for miscommunication and delays to jeopardize your loan.

Dash is different. We changed the home loan process to make it work for you. No middleman, no extra steps. Just a simple process that lets us move fast, so you can too.

|

Download our Booklet to learn more about how we can help you. "*" indicates required fields |

Legal information

¹ Dash Loan Closing Guarantee Disclaimer: Guarantee is based on loan closing; restrictions apply.

² No-Down-Payment Disclaimer: Closing costs and fees may still apply.

³ Lending Disclaimer: Mortgage rates are subject to change and are subject to borrower(s) qualification. APR rate(s) quoted is/are based upon a (loan amount), (loan term, including whether fixed or ARM) year.

⁴ Refinancing Disclaimer: When it comes to refinancing your home loan, you can generally reduce your monthly payment amount. However, your total finance charges may be greater over the life of your loan. Your PRMI loan professional will provide you with a comprehensive refinance comparison analysis to determine your total life loan savings.

⁵ VA Home Loan Disclaimer: VA home loan purchases have options for 0% down payment, no private mortgage insurance requirements, and competitive interest rates with specific qualification requirements. VA interest rate reduction loans (IRRRL) are only for veterans who currently have a VA loan – current loan rate restrictions apply, and limits to recoupment of costs and fees apply. VA cash-out refinances are available for veterans with or without current VA loans. Policies and guidelines may vary and are subject to the individual borrower(s) qualification. Program and lender overlays apply.

⁶ Down Payment Assistance Disclaimer: First lien interest rates may be higher when using a DPA second.

⁷ Pre-Approval Disclaimer: Pre-approvals are given to clients who have met qualifying approval criteria and specific loan requirements at the time of applications. Results may vary.

General Disclaimer: The content on this page has not been approved, reviewed, sponsored, or endorsed by any department or government agency.

NMLS® Consumer Access℠: https://nmlsconsumeraccess.org/